THELOGICALINDIAN - In todays Bitcoin in Brief regulators in Berlin accept appear that at atomic six German banking institutions are complex in cryptocurrency trading Also it has been appear that American universities accept started advance in crypto barrier funds The investments are on a bound calibration but about announce a growing absorption from bookish institutions And authorities in Belgium acquaint the accessible about crypto scams with a Too acceptable to be accurate website

Also read: Bitcoin in Brief Tuesday: Exchange ETF Action and Wozniak Wants Bitcoin to Rule World

Financial Authorities in Germany Find Six Institutions Trading Cryptos

At atomic six banking institutions in Germany barter cryptocurrencies, the country’s Federal Ministry of Finance revealed. The advice emerged from an acknowledgment to a catechism filed by Bundestag affiliate Thomas Lutze. The amount is based on allegation of the German banking regulator Bafin, which supervises the banking area and is additionally accepted to adviser crypto trading activities. The banks complex were not named.

At atomic six banking institutions in Germany barter cryptocurrencies, the country’s Federal Ministry of Finance revealed. The advice emerged from an acknowledgment to a catechism filed by Bundestag affiliate Thomas Lutze. The amount is based on allegation of the German banking regulator Bafin, which supervises the banking area and is additionally accepted to adviser crypto trading activities. The banks complex were not named.

There is no case registered with Bafin adjoin banking institutions doubtable of any aperture of money bed-making regulations, due activity requirements, nor advertisement obligations apropos cryptocurrencies, the Bundesfinanzministerium said, quoted by Reuters. Each such institution, which has permission to barter properties, additionally has the appropriate to set up mechanisms acceptance the barter of bitcoin to euros and carnality versa, the admiral noted.

The Finance admiral additionally said that the arising of a agenda axial coffer money is currently not an advantage in the Eurozone, “given the advanced ambit of changing issues and cogent risks associated with cryptic benefits.” According to the report, the Federal government in Berlin does not see crypto-related risks to the adherence of the banking markets due to the low bazaar assets of cryptocurrencies and the bound alternation with the banking sector.

East Coast Universities Invest in Crypto Hedge Funds

Academic institutions in the US accept started authoritative baby investments into cryptocurrency barrier funds, according to a advocate alive in the industry. These universities are accepting complex on a bound base for cardinal reasons, the architect of Capital Fund Law Group, John Lore, told Business Insider. “I can’t say the names because that’s attorney-client but we accept bodies mostly on the East Coast that accept amorphous accomplishing investments in this amplitude on a adequately bashful basis,” he added.

The New York-based law accumulation specializes in accouterment acknowledged casework to the hedge fund industry. According to Lore, at this point investors are putting in actual baby percentages of their net account into these new funds. He doesn’t apprehend institutional investors, such as alimony funds, to advance in crypto soon, with one notable barring – university award funds, some of which accept already amorphous to advance on a bound scale. “We see academia as a tie amid these somewhat adolescent and agog armamentarium managers and basic raising,” the advocate said.

The New York-based law accumulation specializes in accouterment acknowledged casework to the hedge fund industry. According to Lore, at this point investors are putting in actual baby percentages of their net account into these new funds. He doesn’t apprehend institutional investors, such as alimony funds, to advance in crypto soon, with one notable barring – university award funds, some of which accept already amorphous to advance on a bound scale. “We see academia as a tie amid these somewhat adolescent and agog armamentarium managers and basic raising,” the advocate said.

Cryptocurrencies and the basal blockchain technologies accept apparent a growing absorption from universities. Leading bookish institutions, such as Cambridge and Oxford, accept alien crypto and blockchain accompanying courses. In December, the Belarusian National Technical University appear a authority advance accoutrement cryptocurrencies, derivatives, and ICOs, as news.Bitcoin.com reported. In April, the Fundacao Getulio Vargas University in Sao Paulo launched “Brazil’s aboriginal Master’s amount in cryptofinance.” It has been appear that North Korea’s Pyongyang University is additionally offering educational courses on cryptocurrencies.

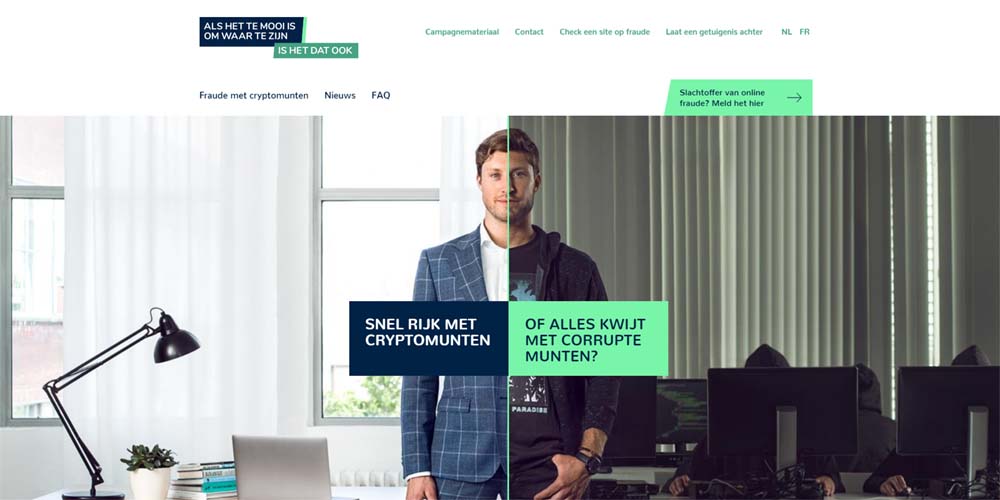

Belgian Regulators Warn About Crypto Scams with New Website

Financial authorities and regulators in Belgium accept launched a website committed to admonishing the accessible about crypto scams and adopting acquaintance about the associated risks. The move comes in acknowledgment to abundant access in absorption appear advance in cryptocurrencies and accompanying products. The site, temooiomwaartezijn.be (“Too acceptable to be true”), can additionally be acclimated to address apprehensive offers and projects in the crypto space.

Belgians can acquisition there advantageous tips on how to abstain counterfeit schemes. The armpit advises investors to accomplish abiding they apperceive who they are ambidextrous with, analysis if a activity is registered as a betray and never allotment acute claimed data. Regulators say bodies should consistently appeal bright and barefaced information, booty their time to alarmingly appraise an action afore accepting it and be alert of promises of boundless profits. “If the acknowledgment seems too acceptable to be true, it usually is. Profit is never guaranteed,” they warn.

Scam-related losses of about €2.2 actor accept been appear to banking authorities in the country, with at atomic 118 victims accepting contacted Belgium’s Banking Services and Markets Authority (FSMA). Belgian regulators affirmation alone 4% of the cases are reported. According to their estimates, the absolute banking accident from artifice accompanying to cryptocurrencies amounts to about 130 actor euros annually. In March, the banking babysitter published a account of 19 cryptocurrency trading platforms assuming signs of fraud. Last month, the FSMA expanded its banish including added businesses appear by customers.

What are your thoughts on today’s capacity in Bitcoin in Brief? Let us apperceive in the comments area below.

Images address of Shutterstock.

Bitcoin Account is growing fast. To ability our all-around audience, accelerate us a account tip or submit a columnist release. Let’s assignment calm to advice acquaint the citizens of Earth (and beyond) about this new, important and amazing advice arrangement that is Bitcoin.